The digital world as we know of and engage with today is built on the cloud. And SaaS, PaaS, and IaaS are its three core pillars. But over the last few years, the SaaS pillar has branched off into two prominent ways: vertically and horizontally.

Where horizontal SaaS caters to diverse groups of industries, vertical SaaS focuses on niche verticals within an industry.

For example, ‘pharmaceuticals’ is a vertical within the chemical industry like ‘nuclear energy’ is within the energy industry and ‘implementation consulting’ is within the consulting industry.

The most common horizontal SaaS companies you have probably come across are Slack, Quickbooks, etc. Whereas brands like Veeva and Clio form the vertical SaaS landscape.

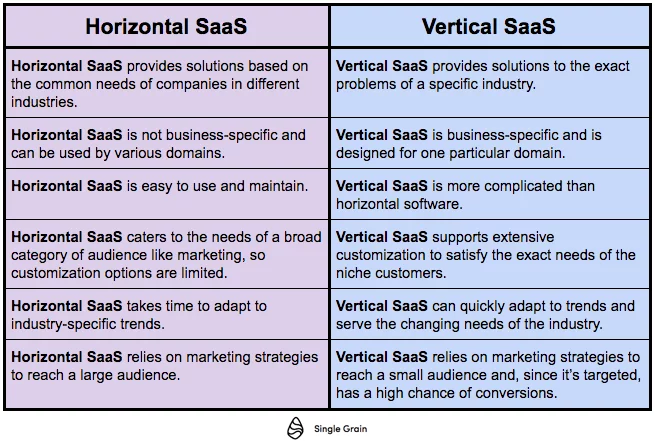

Vertical SaaS Vs. Horizontal SaaS: At a Glance

“Want to establish authority within one industry, including multiple sub-sectors within that industry? If so, then vertical SaaS is the way to go. Want to cater to a diverse set of industries? If yes, then brainstorm horizontal SaaS solutions.”

How is the Vertical SaaS Landscape Taking Over Niche Marketplaces?

As the B2B SaaS landscape becomes more cutthroat, SaaS vendors are shifting focus to vertical SaaS more than horizontal SaaS. Why? Because they want to gain a competitive advantage quickly.

Given the lack of competition in the niche marketplaces, going vertical makes a lot more sense. It can not only boost their revenue automatically but help in forging long-term relationships with clients.

Many experts have even gone on to predict that the future of SaaS lies in niche sectors.

Well, is it?

Remember when private equity (PE) firms were mainly owned by dominant vertical SaaS companies like Vertafore, Tritech, and others?

Gone are the days when they had nothing significant to brag about. Today, several vertical SaaS brands like Veeva, Procore, and more, are posting mind-boggling returns and are publicly listed. Even privately held ones, such as Toast, Benchling, etc., are registering remarkable returns, far more than “modest cash flows!”

Why? Because all these companies are dedicated to solving problems of a specific sector.

For example, Procore has built software opportunities for the construction industry. They offer digital tools that aid with preconstruction, project and workforce management and financial management of construction sites. By designing ERP-type platforms specifically for the construction industry, they have captured a vertical SaaS niche.

On the other hand, Veeva has captured the vertical SaaS space within the pharmaceutical and life sciences industry. It offers an extensive digital ecosystem that supports critical functions, such as R&D, clinical operations and compliances, patient and site management, clinical database management and much more.

Another privately held company, Toast, extends a robust all-in-one Point of Sale or POS system purely for restaurants.

This is happening as four novel mega trends emerge within the B2B vertical SaaS landscape.

B2B Vertical SaaS Landscape : Trends

#1 Helping Client Organizations Increase TAM

Several vertical SaaS companies now promise that businesses can expand their total addressable market or TAM within a niche sector. How? By creating more software as not a lot exists right now, introducing dynamic pricing models, and focusing on contract renewals. This is possible, given that most vertical SaaS organizations have access to quality data, mostly leveraged through AI.

Therefore, to help businesses increase TAM, vertical SaaS brands create more industry-specific software, which also ups their annual contract value or ACV. They target sales not just to different prospects within a vertical but also to the same buyer.

By doing the latter, Shopmonkey, a vertical SaaS auto repair management tool, increased its annual contract value or ACV by 2X. A simple win-win for the brand and its customers.

#2 Returning High Customer Acquisition Rate and Low CLV and CAC

Given the level of niche expertise vertical SaaS companies provide, they experience a high customer acquisition rate (CAR) – often because there isn’t enough competition yet.

Slim competition due to the sheer exclusivity of the software also leads to increased customer lifetime value (CLV). And studies show that vertical SaaS outfits with a high customer acquisition rate (CAR) and increased CLV experience 8 times lower customer acquisition cost (CAC) than their horizontal SaaS counterparts.

Most brands dream of this scenario, which is why many are striving to identify niche sectors to deploy vertical SaaS products.

Free Resource: Flavors of SaaS Research Report

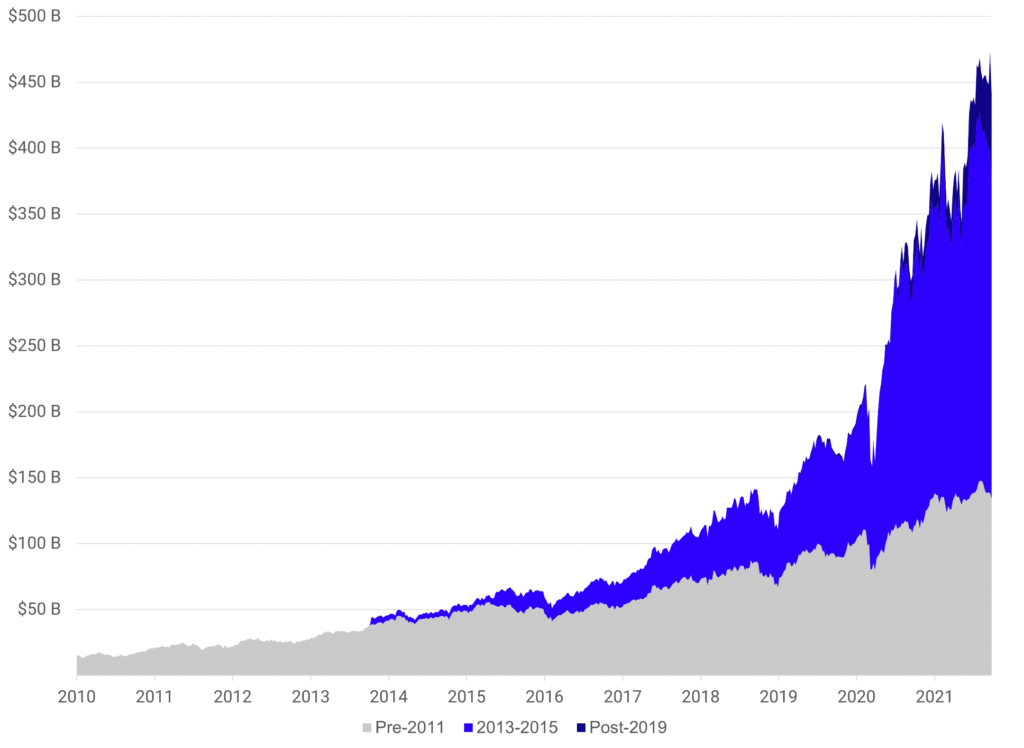

#3 Building New Opportunities for Investors

Vertical SaaS is an unscaled domain waiting to be funded! Why? Because it’s an emerging field with hundreds of specialties waiting to take shape in thousands of unexplored and unexploited niche marketplaces. These include areas such as healthcare, retail, etc. Vertical SaaS solutions for sub-sectors within these sectors remain slim.

Unlike industries like manufacturing, fintech, and communications, where ample SaaS tools are doing the rounds, umbrella sectors like energy, healthcare, insurance, and retail remain ignored. However, this detail has already been picked up by tech companies like Veeva, ClearCare, and Applied Epic, which are creating ripe investment opportunities for investors by way of vertical SaaS.

Simply put, investing in vertical SaaS brands is turning out to be an excellent avenue for investors.

Additional Read: 10 Lessons from a Decade of Vertical SaaS Investing

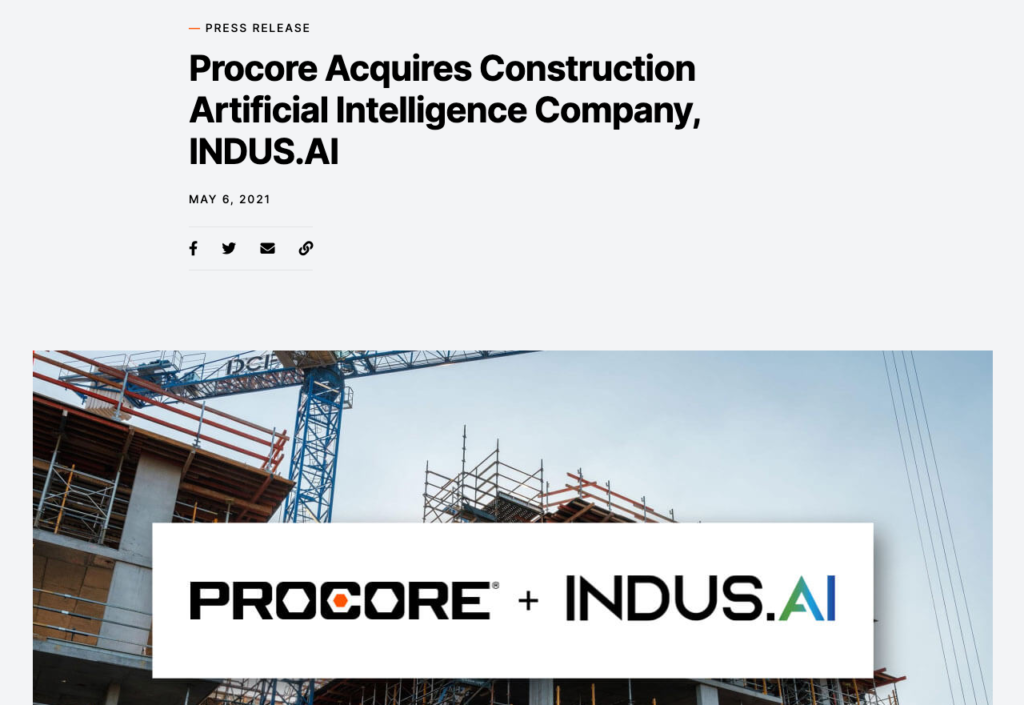

#4 High Scope for Mergers and Acquisitions

Constant product innovation is critical if you want to sustain and grow your vertical SaaS brand in the long term. To do so, you will need to build newer products within your niche, though they don’t always have to come from your team. This is where mergers and acquisitions make more sense.

You can acquire another vertical SaaS company or merge with one if product innovation and scalability is your primary goal.

Here is how the high scope for mergers and acquisitions can benefit vertical SaaS brands:

- You instantly receive rights to a new product in demand

- You expand your customer base and perhaps your TAM

- You churn higher revenue

- Finally, you can quickly expand in global geographies that may demand different design sensibilities and interfaces.

3 Not-so-Vanilla Vertical SaaS Examples

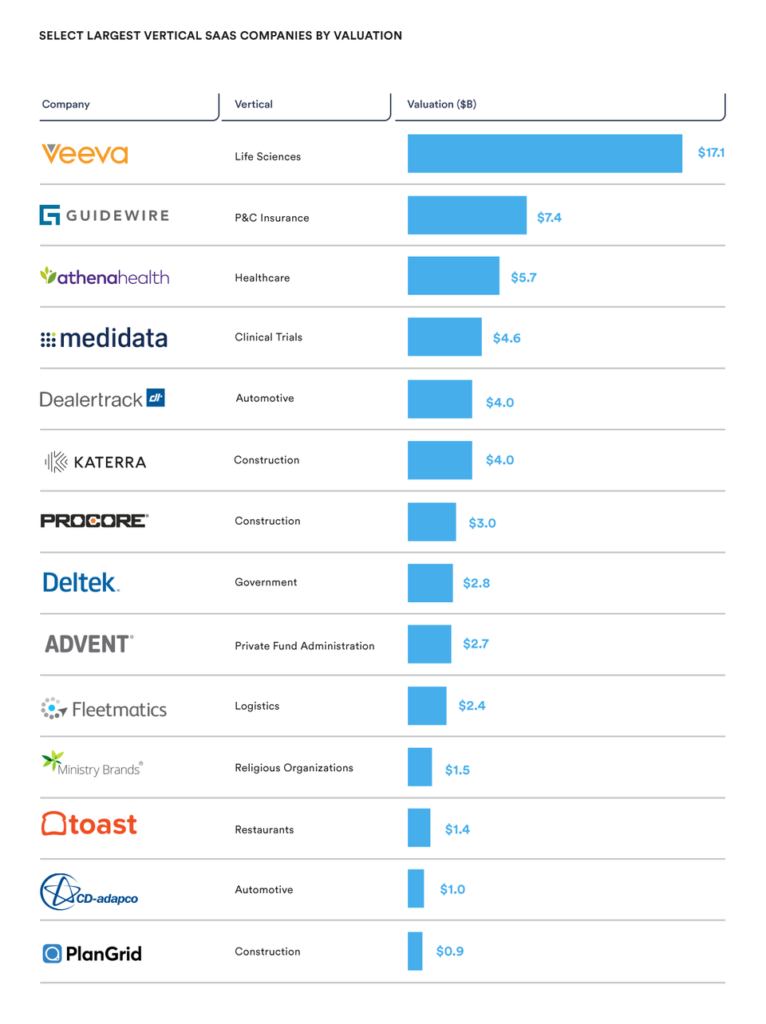

It’s not enough to know ‘what is vertical SaaS’ until you see it in action. For this, you need to know the following three examples elaborated from the picture above. They will provide a perspective on the level of detail B2B vertical SaaS companies go to.

These three examples will also help you understand whether your offering falls in the vertical or horizontal SaaS category. So, let’s quickly check out how three global vertical SaaS companies are shining in their respective niche marketplaces, and are already highly valued.

1. Veeva

‘Service niche – Pharma and life sciences sector within the healthcare industry’

Introducing Veeva, a cloud-based life sciences research vertical SaaS brand. It offers an array of services specifically for life sciences and the pharmaceutical vertical in the healthcare industry. Within its niche, Veeva boasts a broad service portfolio.

From offering a specially designed health science CRM and content management vault to open data resources for about 16 million companies and healthcare professionals, Veeva doesn’t leave many niche stones unturned.

Through this vertical SaaS tool, users can also record conversations between marketing teams and practitioners. Even though Veeva allows for data mining, storing, and segmenting, it ensures compliance first. No wonder this tool is valued at a whopping $7 billion in the picture above.

Straight from the horse’s mouth

“Veeva CRM can be customized based on your company needs, so while implementing the system, teams should define what they want to do with the system. As such, the application is well suited for companies that are well established and know what they are looking for in their marketing team. The system saves a lot of time for the field monitors and allows them to target their customers in a more customized manner.”

~ Verified User | Pharmaceuticals Company | 1001-5000 employees

2. Procore

‘Service niche – Project managers in the construction sector’

Another highly valued vertical SaaS tool from the list, Procore, is becoming essential for construction professionals. This tool specifically makes construction-related project management easy. What’s more, users can access this vertical software across a number of handheld devices and operating systems at any time.

This platform has dedicated interfaces for teamwork collaboration, efficiency measurement, and communication. Managers can view and edit all types of drawings, schedule RFI tools, track projects in real-time, and create punch lists with ease.

Given that construction project management is a complex affair, it happens to be Procore’s niche area of expertise. Through this tool, users can streamline documents, update changes and address their team’s unique needs in real-time.

Straight from the horse’s mouth

“Procore is great for General contractors who work with many different subs. Procore keeps everyone informed and coordinated. You can also use Procore with Docusign to make it even easier to get important docs approved.”

~ David Wilson | Director of Information Technology, Hedrick Brothers Construction | 51-200 employees

3. Guidewire

‘Service niche – Property and casualty insurers within the insurance sector’

Meet Guidewire – 2nd on the list of top valued vertical SaaS brands and a personal favorite of property and casualty (P&C) insurers. This tool combines AI and data to provide services like automated billing and invoicing, claims management, and policy management.

P&C insurers also use this personalized vertical SaaS tool for underwriting management and rating insurance. Additionally, it extends user-friendly dashboards to brokers, agents, and end customers.

Straight from the horse’s mouth

“The comprehensiveness of the Guidewire software stands out from the alternative products along with the integrations available for this product with the other two major components such as Billing or Claims is awesome. It makes life easier to focus on the actual work rather than thinking of the change in the product.”

~ LinkedIn Verified User | Insurance industry | 10,0001+ employees

Conclusion

By extending tailored offerings to a smaller, more reliable lead pool, vertical SaaS brands have been steadily boosting conversions. Now, with the availability of API integrations, AI, and blockchain technologies, they can quadruple the efforts.

Safe to say, vertical SaaS is taking over.

1 thought on “Explained: How Vertical SaaS is Taking Over Niche Marketplaces?”